vermont department of taxes myvtax

You may now close this window. Sales and Use Tax for multiple locations.

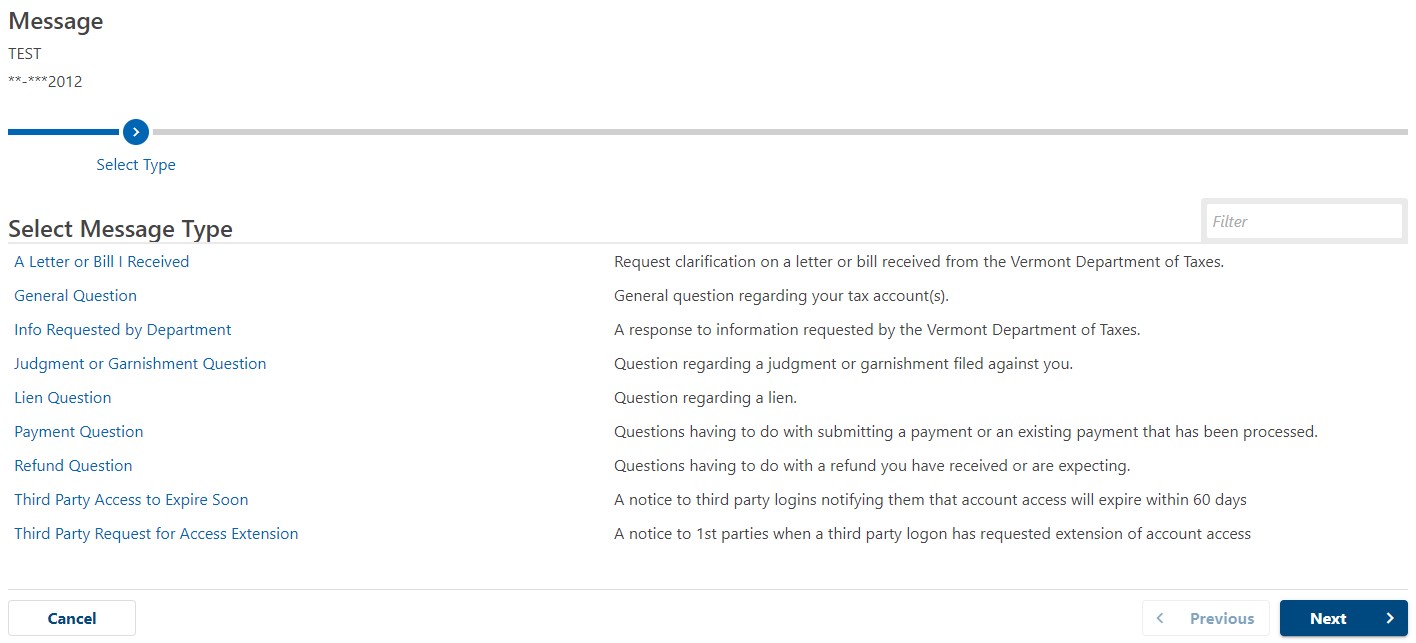

Respond to Correspondence.

. Please provide a daytime number where you can be. The timeline below shows the tax types that will be converted each year. The Vermont Department of Taxes is pleased to announce the launch of VTax a modern integrated tax system to perform all functions for all Vermont tax types.

If mailing your return with a payment mail to. Please include your Business Tax Account number. 335 percent if your taxable income is 1 to 40950 and youre filing single or if your taxable income is 1 to 68400 and youre married filing jointly.

Fields marked with an asterisk are required. GB-1229 - Vermont Department of Taxes ACH Credit Processing. 66 percent if you taxable income is 40951 to 99200 and youre.

They vary based on your filing status and taxable income. The portion used for business is taxed at the nonhomestead rate. GB-1119 - WHT-434 Specifications for Electronic Filing copy.

MyVTax the Departments online filing portal. W-4VT Employees Withholding Allowance Certificate. If your email address has changed since the time you first registered or you experience any other problem with your password or username please contact the Taxpayer Services Division or by completing the form below.

Vermont Department of Taxes ACH Credit Processing 133 State Street Montpelier VT 05633-1401 The following instructions provide information for taxpayers wishing to submit an ACH Credit payment to the Vermont Department of Taxes VDT for the following tax types. Statewide Public Records Database. Submit Your Payment by Mail.

File and Pay Your Taxes Vermontgov Freedom and Unity. My Free Taxes Partnership. Click the Sign Up hyperlink in the Sign in panel on the myVTax Home Page.

Vermont Department of Taxes Issues. To 430 pm Monday through Friday. PA-1 Special Power of Attorney.

Mandate to File Using myVTax It has been mandated that taxpayers must use myVTax to file returns for the following tax types. Our tax examiners are available Monday through Friday from 745 am. Fact Sheets and Guides.

The 2083 business use 2501200 is rounded to 21. You can also email myVTax support or call us at 802-828-6802 or 802-828-2551. Send us a message in the form below.

Enable pop-ups when working in myVTax. Pay Traffic Tickets and Court Violations Online Judiciary Pay the fine for a Vermont Civil Violation Complaint Municipal Complaint or. Vermont has four state income tax brackets for the 2021 tax year.

The service is by appointment only on Mondays and Wednesdays at the Vermont Department of Taxes 133 State Street Montpelier. We would like to show you a description here but the site wont allow us. How do I sign up for myVTax.

Vermont School District Codes. Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am. IRS Virtual Service Delivery in Montpelier.

Please contact the Vermont Department of Taxes Taxpayer Services Division at 802 828-6802 or myVTaxSupportvermontgov. We are here to answer any questions you have about myVTax. B 1200 square foot home with 250 square feet used as a home office.

The conversion to VTax will take place over four years beginning in 2014 with completion scheduled for 2017. 1st Floor Lobby 133 State Street. Vermont School District Codes.

VTax ACH Credit Payment Options Tax Type Taxpayer ID Preˇx Tax Type Code. Because this is less than 25 enter 0000. Vermont Department of Taxes PO Box 1779 Montpelier VT 05601-1779.

MyVTax is available for corporate and business taxpayers to file their income taxes employer withholding tax sales and use tax meals and rooms tax and other business tax types. Call 844-545-5640 to schedule an appointment. Department of Taxes httpsmyvtaxvermontgov_ No Support.

Vermont School District Codes. You will need to collect the following information before you. The 3528 is business use 6351800 is rounded to 3500.

You have been successfully logged out. Sign Up for myVTax. B-2 Notice of Change.

Pop-up blockers may prevent certain windows from appearing. Vermont Department of Taxes 133 State Street 1st Floor Montpelier VT 05633-1401. IN-111 Vermont Income Tax Return.

745 AM - 430 PM. MyVTax walks you through Vermont Form HS-122 Homestead Declaration and Property Tax Credit and Schedule HI-144 Household Income. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal.

Our office hours are 745 am. Sign Up for myVTax. Sign Up for myVTax.

Guide Tue 01112022 - 1200. Mon Tue Thu Fri 745 am-430 pm. Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes.

Department of Taxes Use myVTax the departments online portal to electronically pay your Estimated Income Tax. Get Help with myVTax.

Vt Form In 114 Download Fillable Pdf Or Fill Online Vermont Individual Income Estimated Tax Payment Voucher 2021 Vermont Templateroller

Personal Income Tax Department Of Taxes

Vermont Department Of Taxes Facebook

Download Instructions For Vt Form Sut 451 Sales And Use Tax Return Pdf Templateroller

Vermont Department Of Taxes Facebook

About The Department Department Of Taxes

Rp 1231 Vermont Department Of Taxes Organizational Chart Department Of Taxes

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube

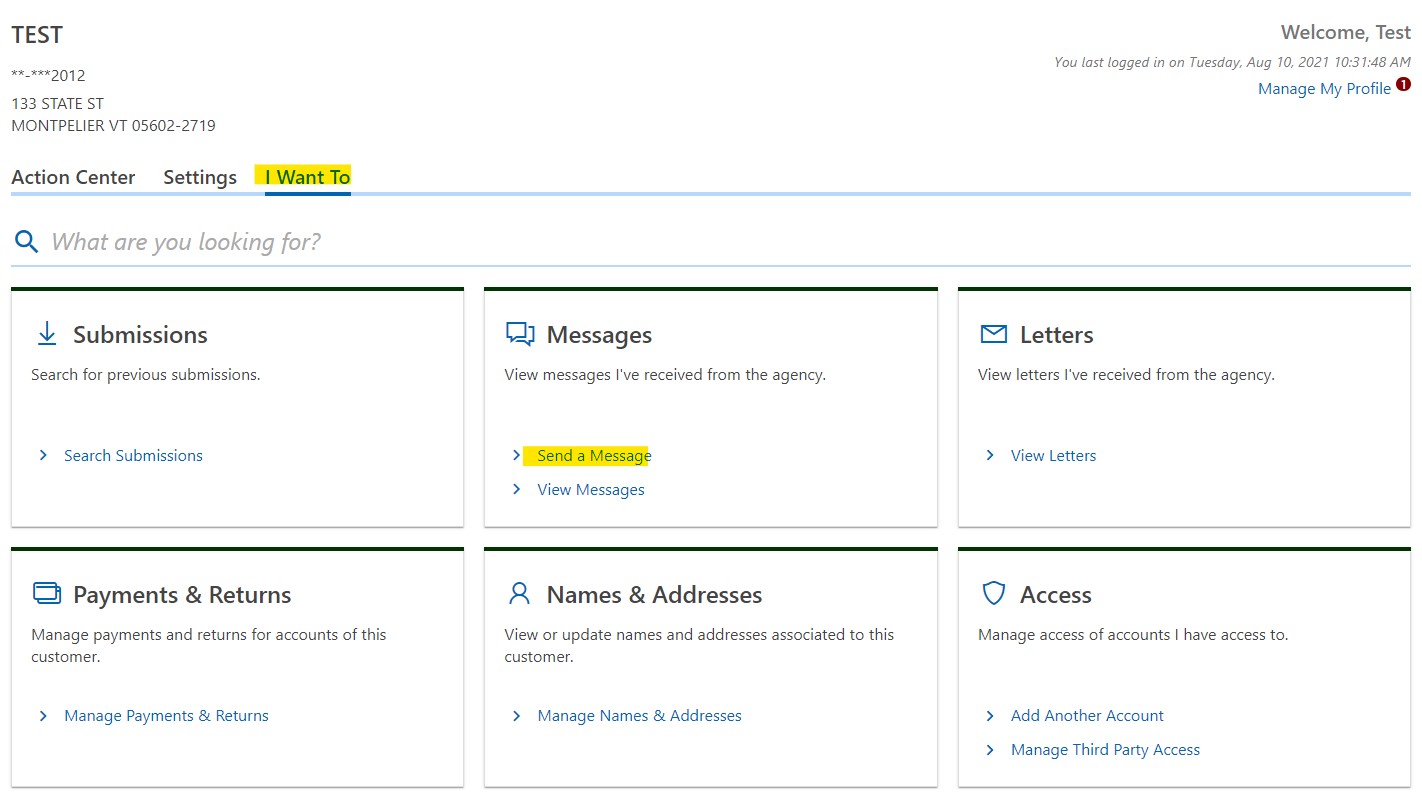

How To Send A Secure Message Department Of Taxes

Vermont Department Of Taxes Facebook

Declaring Your Vermont Homestead Most Situations The Basics Youtube