steamboat springs colorado sales tax rate

What is the sales tax rate in Steamboat Springs Colorado. Weber appeared before Steamboat Springs City Council during their meeting on Tuesday July 19 and provided a sales tax forecast for 2023 that was both optimistic and concerning.

Property Tax South Dakota Department Of Revenue

Select the Colorado city from the list of cities starting with A below to see its current sales tax rate.

. The sales tax rate is always 84 Every 2021 combined rates mentioned above are the results of Colorado state rate 29 the county rate 1 the Colorado cities rate 45. STEAMBOAT SPRINGS COLORADO - June 15 2022 -. Starting in 2020 thats no longer the case.

312 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS. The May 2022 sales taxes for the City of Steamboat Springs are 6. The sales tax rate does.

STEAMBOAT SPRINGS As of Tuesday Steamboat Springs was one of only six municipalities in Colorado that doesnt levy a property tax. This is the total of state county and city sales tax rates. 52 higher compared to the May 2021 collections or an increase of 126 909.

Total Combined Tax Rate. Who Needs a Sales Tax License. 45 City of Steamboat Springs sales tax and 10 Accommodations tax is collected on all taxa- ble transactions and is remitted to the City of Steamboat Springs.

The city has published the. Tax Jurisdiction Tax Rate State of Colorado 29 Routt County 10 City of Steamboat Springs 45 Total combined sales tax rate inside the City 84 Documentation provided outside City no permits or certificates 84 39 County building permits 74 29 City building permits 29 29 sales tax licenses 00 00 exemption certificates 00 00. Excise taxes are taxes paid when purchases are made on a specific good or a specific activity occurs.

The Steamboat Springs Sales Tax is collected by the merchant on all qualifying sales made within Steamboat Springs. Year - to - date sales tax collection is 27. The 84 sales tax rate in Steamboat Springs consists of 29 Colorado state sales tax 1 Routt County sales tax and 45 Steamboat Springs tax.

The April 2022 sales taxes for the City of Steamboat Springs are 5. The state sales tax rate in Colorado is 2900. This includes the sales tax rates on the state county city and special levels.

While the year-to-date 2022 sales tax numbers are strong compared to previous years year-to-date gains have shrunk each month since February. CO Sales Tax Rate. You can print a 84 sales tax table here.

With local taxes the total sales tax rate is between 2900 and 11200. Colorado has recent rate changes Fri Jan 01 2021. 29 State of Colorado 10 Routt County and if applicable 20 Local Marketing District tax is remitted to the State.

The question of whether to tax short-term rentals an additional 9 and use the proceeds to support the build out of the Brown Ranch is now in the hands of Steamboat Springs voters. The May 2022 sales taxes for the City of Steamboat Springs are 6. The County sales tax rate is.

The current total local sales tax rate in Steamboat Springs CO is 8400. Total Combined Tax Rate on Accommodations. 24 higher compared to the April 2021 collections or an increase of 96 969.

52 higher compared to the May 2021 collections or an increase of 126 909. 20 Rentals within the Local Marketing District. 15 of calculated rate.

The December 2020 total local sales tax rate was also 8400. The Steamboat Springs sales tax rate is 45 Steamboat Springs accommo- dations tax rate is 1 of the retail purchase price. Steamboat Springs is located within Routt County Colorado.

The combined amount was 825 broken out as followed. Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range. The 42 max local sales tax allowed under Colorado law.

The term In the City of Steamboat Springs refers to any tangible personal property or tax- able service that is provided or delivered to the pur- chaser within the City limits. The average cumulative sales tax rate in Steamboat Springs Colorado is 84. The Colorado sales tax rate is currently.

Groceries are exempt from the Steamboat Springs and Colorado state sales taxes. Stoneham CO Sales Tax Rate. Steamboat Springs collects a 0 local sales tax less than.

Within Steamboat Springs there are around 2 zip codes with the most populous zip code being 80487. 43 more than year to date through the same period last year. 42 cents per cigarette.

After getting Steamboat Springs City Council approval on Tuesday July 19 the question of whether add a 9 tax on short-term rental stays is in the hands of voters. Ballot measure 2A passed earning 2882 yes votes to 1831 no votes with an estimated 125 to 150 ballots remaining county-wide to be counted once. Steamboat Springs in Colorado has a tax rate of 84 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Steamboat Springs totaling 55.

The Steamboat Springs Sales Tax is levied on all Sales leases and rentals at Retail on the basis of. The Steamboat Springs sales tax rate is. Final April 2022 sales use and accommodation tax report.

For the past 5 years May collections represent about 5 of annual collections. The minimum combined 2022 sales tax rate for Steamboat Springs Colorado is. Did South Dakota v.

For tax rates in other cities see. There is no applicable special tax. You can find more tax rates and allowances for Steamboat Springs and.

Multiple fuel taxes alcohol fees etc. STEAMBOAT SPRINGS COLORADO - July 14 2022 - The city has published the Final May 2022 sales use and accommodation tax report. Steamboat Springs in Colorado has a tax rate of 84 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Steamboat Springs totaling 55.

Free Filemaker Pro Starter Solutions Download Apps Run On Mac Pc Ipad Iphone Noche Loca Noche Pdf Gratis Descargar

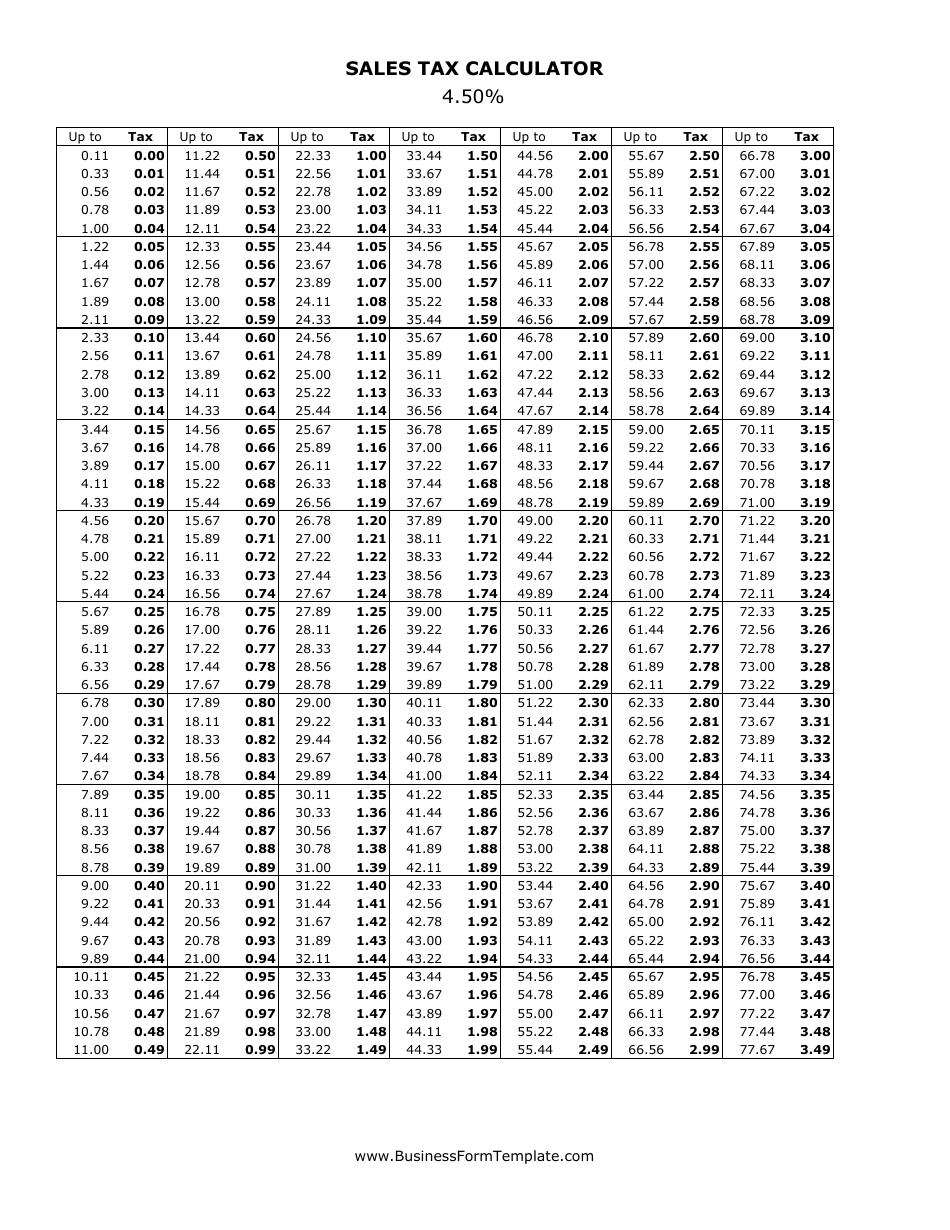

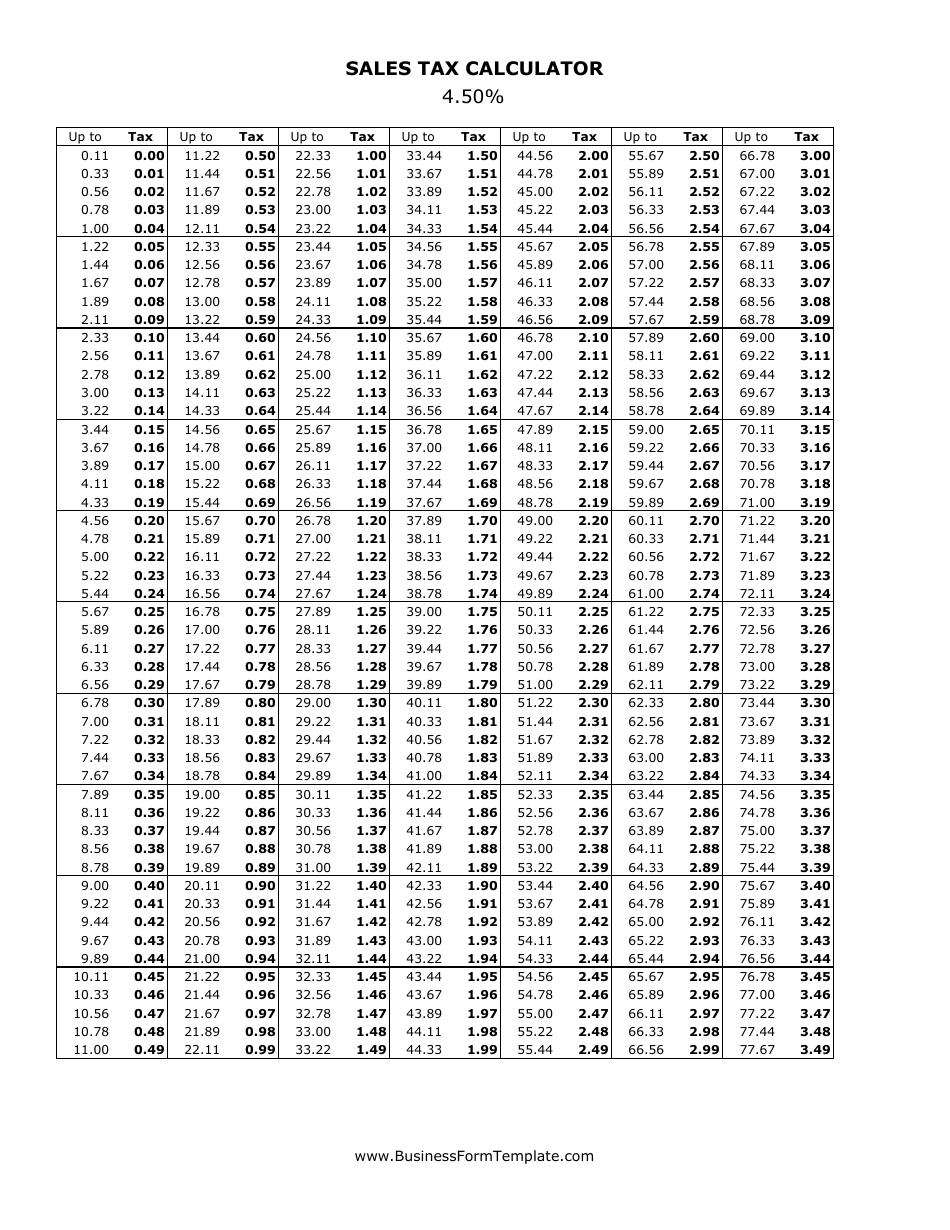

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

Steamboat Springs Economy Top Industries Biggest Employers Business Opportunities

Pennsylvania Clarifies Telecom Electric Tax Rules Grant Thornton

Pennsylvania Clarifies Telecom Electric Tax Rules Grant Thornton

Property Tax South Dakota Department Of Revenue

Relocating To Denver Co From The Bay Area Cost Of Living Comparisons

Silverthorne To Ask Voters For Lodging Tax Increase In April Municipal Election Summitdaily Com

Englewood Beach Resorts Sea Oats Beach Club Englewood Beach Resorts Englewood Beach Beach Club Beach Resorts

Property Tax South Dakota Department Of Revenue

Economy In Sullivan County New York

Property Tax South Dakota Department Of Revenue

Steuben County Legislature Adopts 221 Million Budget Tax Changes

Property Tax South Dakota Department Of Revenue

Vintage Little Suitcase Travel Theme Ocean Liner Bon Etsy Bon Voyage Travel Themes Cosmetic Case

Sales Tax Messaging Email Templates Messages Sales Tax

Alpenglow Village On The Horizon Apartment Communities Affordable Housing Village